Manchester United's share price has sky-rocketed following claims that Qatari banker Sheikh Jassim bin Hamad al Thani has had a bid for the Premier League club accepted.

Reports originating from Qatar claimed on Monday night that Sheikh Jassim has been successful with his fifth and final offer for United.

The bid, submitted through his Nine Two Foundation, is understood to be worth around $6.5bn (£5.2bn), while $1bn (around £800m) of additional investment in the club has also been pledged.

Advert

The rumours of the successful bid involved senior officials at Qatari media organisations linked to the family of Sheikh Jassim, according to the BBC.

It is claimed that sources involved in the takeover process have played down the accuracy of the reports.

Nevertheless, they have had a major impact on United's share price on the New York Stock Exchange.

Shares in the club jumped nearly 25 per cent in pre-market trading on Tuesday following the reports, at one point reaching $26.20 (£20.85).

The share price has since retreated to $24.30 (£19.33).

What will happen with the share price?

The BBC’s economics editor Faisal Islam believes the price could surpass $30 (£23.87) in the event of a successful takeover by Sheikh Jassim.

Advert

“In now pre-market trading in NY, United share price now up 24% on last nights close, to $25 a share…adding close to $1bn to value,” tweeted Islam on Tuesday morning.

“Indicates some traders in thin trading betting on Qatari takeover… but would be even higher, closer to / above $30 in a done deal scenario.”

Sheikh Jassim submitted his fifth bid for the club last week, warning it was his final offer for the Premier League club.

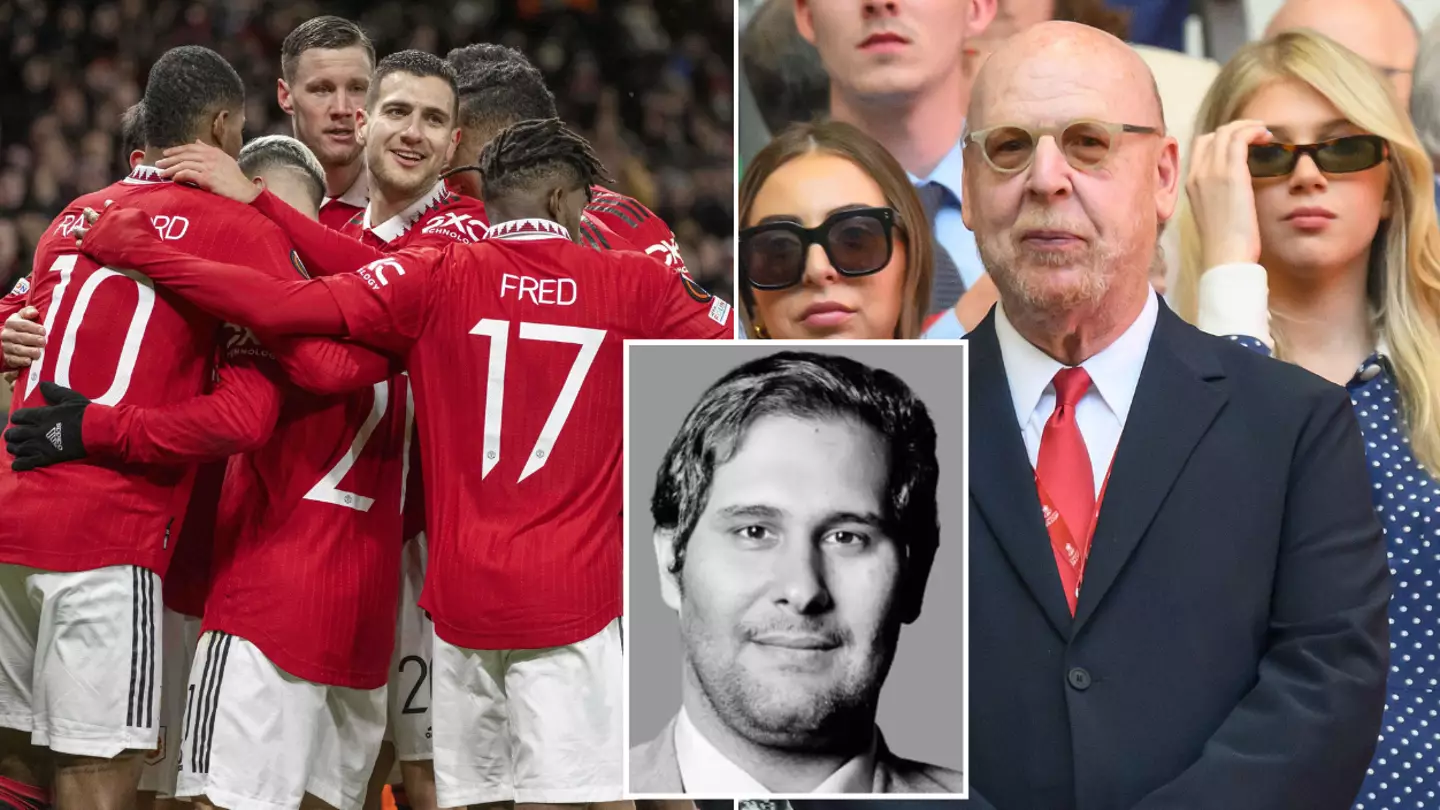

Sheikh Jassim is seeking to buy 100 per cent of United whereas his main rival, Sir Jim Ratcliffe’s INEOS Group, are seeking a controlling stake over 50 per cent which could allow the Glazer family to retain some involvement in the club.

Advert

Raine, the American banking group handling the potential sale of behalf of the Glazers, are yet to name a preferred bidder – more than 200 days since the club was first put on the market.

Featured Image Credit: Alamy & PATopics: Manchester United, Football, Premier League